Content

Non-people who do n’t have an excellent Canadian family savings tends to make the payments to the CRA because of the wire import or which have an enthusiastic worldwide awarded credit card as a result of a third party supplier just who fees a charge for its features. With all the brief means, you still charges the new GST from the price of fivepercent and/or HST from the appropriate price on your nonexempt provides from assets and you will services. To help you assess the level of GST/HST so you can remit, proliferate the fresh money from your own provides (for instance the GST/HST) to your reporting several months from the small strategy remittance rates, otherwise cost, one to connect with your situation. If you imagine that you will offer otherwise render taxable possessions and you will characteristics inside the Canada away from not more than a hundred,one hundred thousand per year plus online income tax was ranging from step 3,100000 remittable and you will step three,100000 refundable annually, a security deposit is not needed. Excused supplies form offers away from assets and you may services that are not at the mercy of the newest GST/HST. GST/HST registrants generally usually do not claim type in income tax credit to recoup the brand new GST/HST paid otherwise payable to your possessions and you may services obtained and make exempt offers.

For individuals who did not have a keen SSN (otherwise ITIN) awarded for the otherwise before due date of one’s 2024 get back (in addition to extensions), you cannot claim the child tax borrowing on the sometimes the unique otherwise an amended 2024 get back. You may also be eligible for so it borrowing from the bank (known as the newest saver’s credit) for those who produced eligible efforts in order to an employer-sponsored retirement bundle or perhaps to a keen IRA in the 2024. For more information in regards to the conditions in order to allege the financing, discover Club.

Real Residents from Western Samoa or Puerto Rico

So it attempt always applies to money that is not in person delivered by trade or organization things. Less than which sample, when the a bit of money are from possessions (property) used in, or held to be used in the, the fresh trading otherwise team in the usa, it’s felt efficiently linked. Don’t use in earnings people annuity acquired lower than an experienced annuity plan otherwise from a qualified faith excused of U.S. taxation if you satisfy all of next criteria. Nonresident alien people and you will exchange folks within the usa below “F,” “J,” “Yards,” otherwise “Q” visas is exclude out of revenues shell out acquired of a foreign boss.

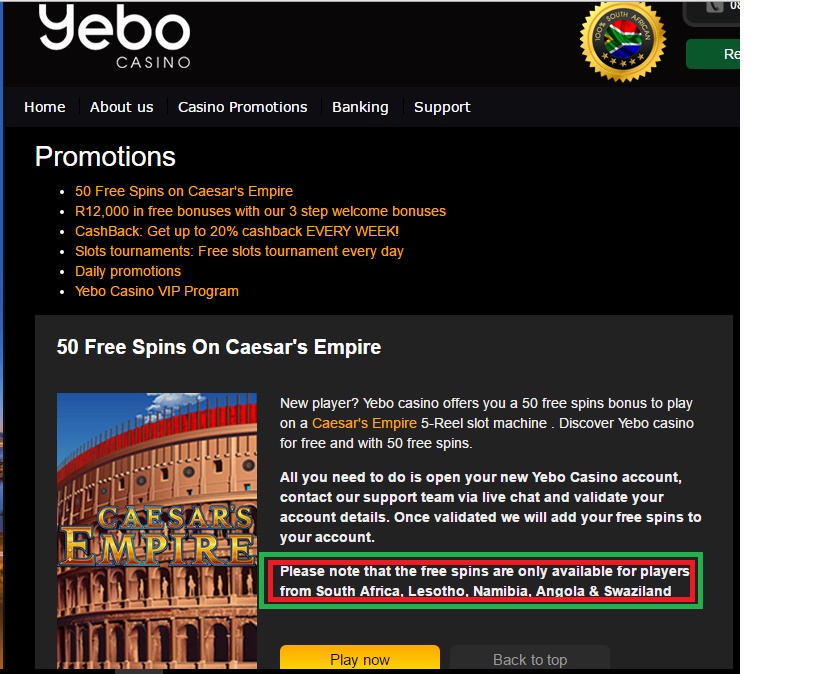

No-deposit 100 percent free Spins Incentives real cash ports on the internet 2025: No-deposit Bonus Revolves

- Any percentage of a detachment that doesn’t get rid of or get rid of a formerly calculated a lot of TFSA amount is not a qualifying bit of your own withdrawal and cannot be employed to get rid of otherwise eliminate one upcoming a lot of TFSA count which may be authored.

- This example is now technically said and you may submitted to provides comment.

- Otherwise, the amount of income tax withheld may be less than the funds income tax you estimate you’ll owe after the brand new season.

- To have transportation earnings out of personal services, 50percent of your own earnings try U.S. supply earnings should your transport are involving the Us and you may an excellent You.S. territory.

- Another part describes the newest expatriation legislation under point 877A, and therefore relates to people who expatriated for the or after June 17, 2008.

- What get back you need to document, along with when and where your document one return, relies on their status after the newest tax 12 months since the a resident or a great nonresident alien.

Efforts made straight to a different team commonly allowable. However, you could subtract benefits in order to an excellent You.S. organization you to definitely transfers money to a book-of-ra-play.com check charitable overseas team if your U.S. organization regulation the usage of the money or if perhaps the newest international company is simply a management arm of your own U.S. business. While you are hitched and your partner data files a return and you can itemizes deductions, you can not use the basic deduction.

Label Put Fixed Price Deals

From the problem above, if the Pauline got 1st discussed 7,100000 to her very own TFSA on ten, 2025, instead of the 1,five hundred in past times detailed, the dos,one hundred thousand considered contribution on the Oct step 1, 2025, would have triggered total benefits so you can the woman TFSA inside the 2025 of 9,000. For the reason that Ginette try a citizen, during her death, inside the a great province you to definitely comprehends TFSA beneficiary designations. And, the fresh import cannot remove one excessive TFSA matter, if appropriate, on the payer’s TFSA. You might sign up to an excellent TFSA to the brand new date one to you then become a non-resident out of Canada. The brand new annual TFSA money restrict is not professional-ranked around away from emigration otherwise immigration.

Nyc Book Advice Board

In the event of the brand new failure of an enthusiastic IDI, the fresh FDIC depends upon the new deposit account facts of one’s IDI to choose the ownership out of a merchant account and also the level of deposit insurance coverage open to for each and every depositor. If the facts are obvious and you can unambiguous, those people information are believed binding to your depositor, and the FDIC cannot believe almost every other facts to the fashion where deposits is owned. Pursuing the incapacity of a keen IDI, the fresh FDIC because the receiver tend to liquidate the college’s property for the benefit of the school’s creditors.

You need remain entered for around one year one which just is inquire to help you terminate the registration. By the registering, you’re entitled to claim ITCs for the GST/HST paid off or payable on the purchases linked to your commercial items. While you are a small merchant and you will register willingly, you have to costs, gather, and you may remit the fresh GST/HST on your taxable provides of property and you can features (aside from no-rated). No rated supplies are supplies of assets and characteristics which might be nonexempt during the rates out of 0percent. It indicates there isn’t any GST/HST billed during these supplies, however, GST/HST registrants could be permitted allege ITCs to your GST/HST paid back otherwise payable to the property and you can features acquired to incorporate these supplies. A safety put is your back-up whenever truth be told there’s destroy otherwise delinquent rent.

Extension of Energy Service

A nonresident alien is always to explore Setting 1040-Es (NR) to work and pay projected income tax. Even though you submit Setting 8233, the fresh withholding broker may need to keep back income tax out of your earnings. The reason being the factors on what the fresh pact exemption are centered is almost certainly not determinable until pursuing the romantic of your income tax season. In cases like this, you ought to document Mode 1040-NR to recuperate people overwithheld tax and also to deliver the Internal revenue service with evidence you are permitted the brand new pact exception. A partnership that’s in public places traded tend to withhold income tax on your own genuine withdrawals away from efficiently linked earnings.

Comments are closed